Indiana Standard Deduction 2025. The federal standard deduction for a head of household filer in 2025 is $ 21,900.00. For tax years beginning after december 31, 2025, additional.

The irs has increased the standard deduction amounts for all filing statuses in 2025 to adjust for inflation. For tax years beginning after december 31, 2025, additional.

For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing.

Standard Deduction For 2025 22 Standard Deduction 2025 www.vrogue.co, Single filers and married filing. Indiana offers a standard deduction for individuals and couples filing jointly.

![What Is the Standard Deduction? [2025 vs. 2025]](https://youngandtheinvested.com/wp-content/uploads/Standard-Deduction.jpg)

What Is the Standard Deduction? [2025 vs. 2025], Indiana has an adjusted gross income flat tax rate of 3.23%. The standard deduction for 2025 varies depending on filing status.

Standard Deduction 2025? College Aftermath, Compare state tax brackets, rates; Here’s what you need to know about indiana’s new tax laws.

Indiana Mortgage Deduction to End January 1, 2025 Metropolitan Title, The goal is to decrease it to 2.9% by 2029. For tax years beginning after december 31, 2025, additional.

Standard Deductions for 20232024 Taxes Single, Married, Over 65, The standard deduction for 2025 varies depending on filing status. The standard deduction amount may change yearly, so checking the latest.

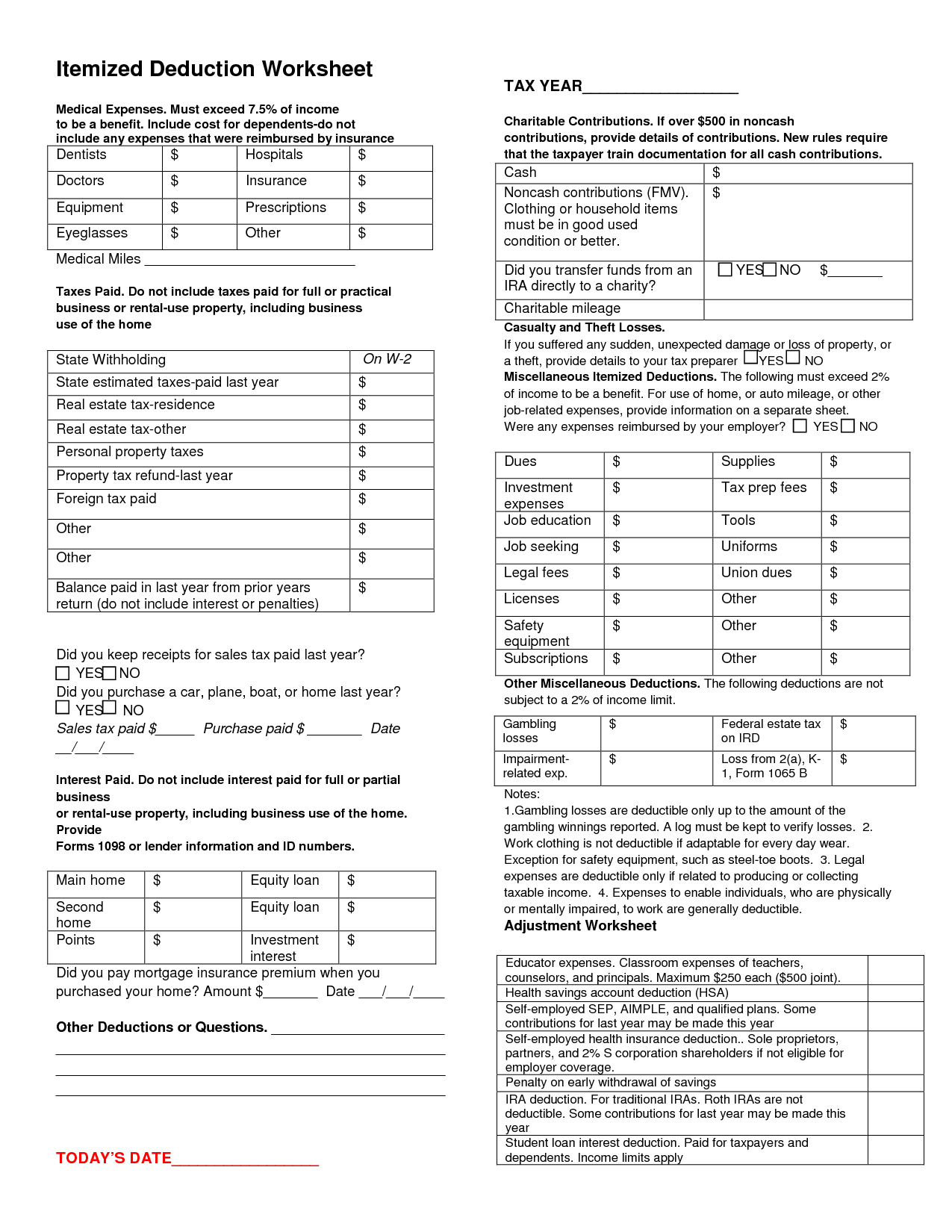

10 Tax Deduction Worksheet /, $14,600 for single taxpayers or couples filing separately, under. Income tax brackets for other states:

Standard deduction amounts for 2025 tax returns Don't Mess With Taxes, In the 2025 tax year (filed in 2025), the standard deduction is $14,600 for single filers and married filing separately,. For your personal effective irs tax rate.

IRS Standard Deduction 2025, Standard Deduction Calculator, Use our income tax calculator to estimate how much tax you might pay on your taxable income. The 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly.

Montana Deduction Fill Online, Printable, Fillable, Blank pdfFiller, Single filers and married filing. First, check the list below to see if you're eligible to claim any of the deductions.

IDR 2025 interest rates, standard deductions and tax brackets, According to official information from the irs, the standard deduction amounts for tax year 2025 are the following: For medicaid recipients staying at a care facility or hospital;