Fuel Tax Credits 2025. You can claim for taxable fuel that you. Arnold shipping know that they can claim a credit for the effective.

The fuel is eligible for a fuel tax credit because the bunker fuel was purchased for the carrying on of a business. The inflation reduction act (ira) extended the biodiesel and renewable diesel income tax credit through december 31, 2025.

Changes to fuel tax credit rates Paris Financial Accounting And, If already registered for gst, the registration for fuel tax credits can be added by an.

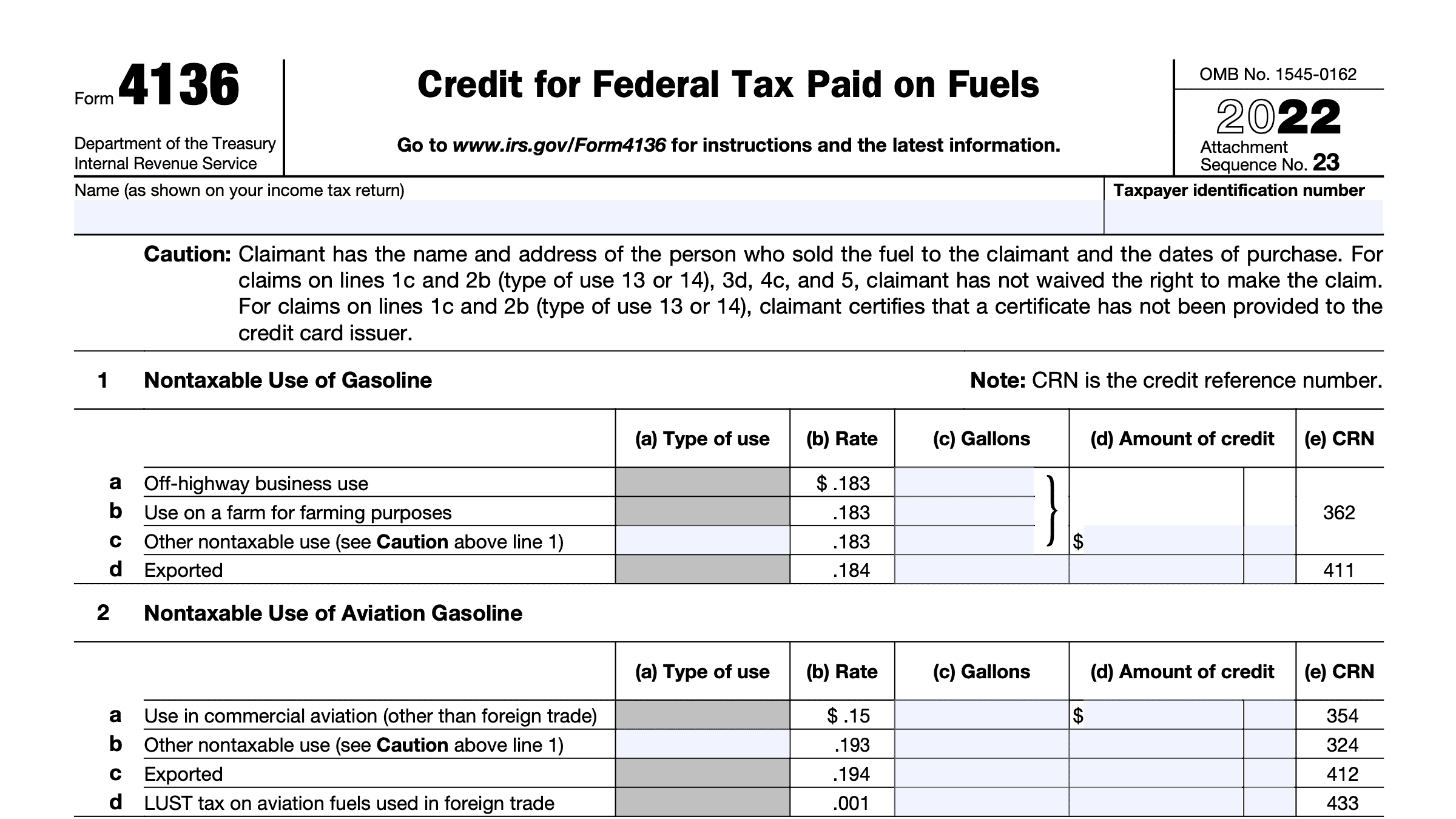

Fuel Tax Credit Eligibility, Form 4136 & How to Claim, Businesses can claim credits for the fuel tax (excise or customs duty) included in the price of fuel used in their business activities.

Fuel Tax Credits » Banlaw, Learn about fuel tax credits, including eligibility, calculation methods, documentation, and recent regulatory updates in this comprehensive guide.

Tips For Getting Your Fuel Tax Credits Claim Right Marsh & Partners, How to register for fuel tax credits.

Fuel Tax Credits Explained BOX Advisory Services, You need to use the rate that applies on the date you acquired the fuel.

Alternative Fuel Excise Tax Credit What is it and Who Qualifies? RKL LLP, Check the fuel tax credit rates from 1 july 2025 to 30 june 2025 for business.

Fuel Tax Credits 2025 Rates Minna Sydelle, Currently, the road user charge reduces fuel tax credits for gaseous fuels to nil.

How to Claim Fuel Tax Credits and Reduce Your Business Expenses in 2025, Chariff calculated that the $7,500 credit could shrink a buyer's monthly payment by between $200 and $250, allowing many to afford an ev.